International Carriage Onboarding – UPS Returns to the UK

This guide outlines all the information you’ll need to get started with our International Carriage service, including details about eligible return countries and the onboarding process.

Overview

If you choose to onboard with Cross Border Carriage, there are no additional fees for the onboarding process.

The process typically takes up to 10 working days before the carrier can be used.

To ensure a smooth onboarding experience, please have the following information ready before you begin.

Before moving to the onboarding steps, here is demo showcasing the entire onboarding process.

Onboarding Steps

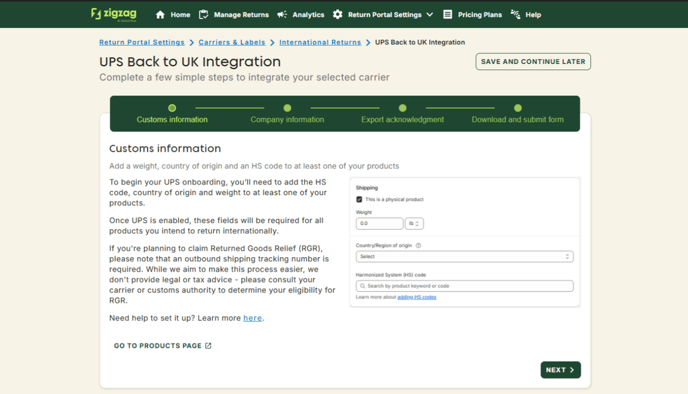

Step 1 – Customs Information

To begin, you must have at least one product in your store with the following fields completed:

- HS Code (Harmonized System Code)

- Country of Origin

- Product Weight

If you’re unsure where to add this information, please refer to the Shopify Documentation.

Please note that weight is required to be added to every product so that labels don’t fail. The other fields are recommended to have present so that products don't get stuck at costumes.

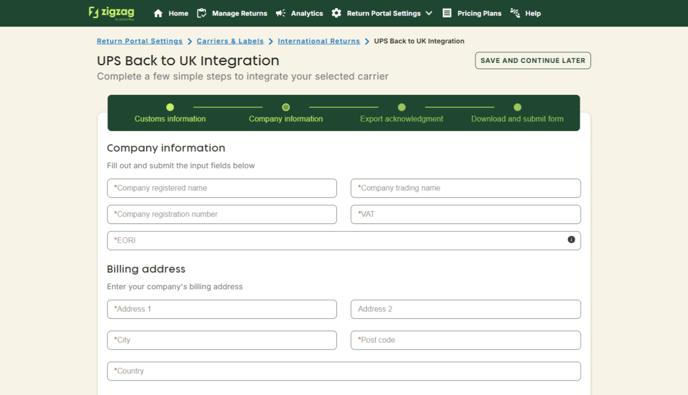

Step 2 – Company Information

We’ll need to collect your company’s details:

- Company Registered Name

- Company Trading Name

- Company Registration Number

- VAT Number

- EORI Number

- Billing Address (Address 1, Address 2, City, Postal Code, Country)

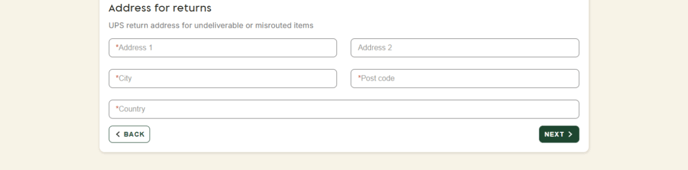

- Return Address (Address 1, Address 2, City, Postal Code, Country)

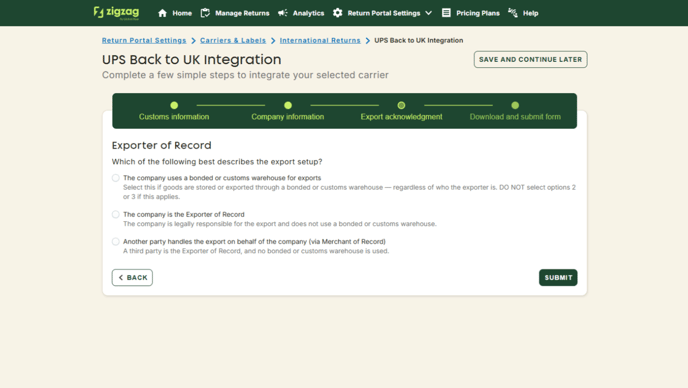

Step 3 – Export Acknowledgement

We need to know which of the following three situations best describes your business:

- The company uses a bonded or customs warehouse for exports

(Select this if goods are stored or exported through a bonded or customs warehouse — regardless of who the exporter is. DO NOT select options 2 or 3 if this applies.) - The company is the Exporter of Record

(The company is legally responsible for the export and does not use a bonded or customs warehouse.) - Another party handles the export on behalf of the company (via Merchant of Record)

(A third party is the Exporter of Record, and no bonded or customs warehouse is used.)

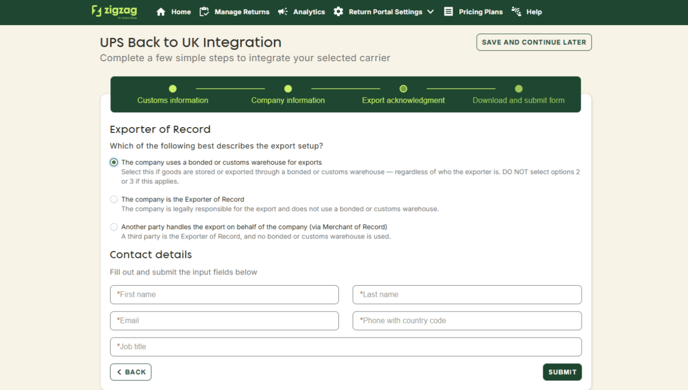

If you select Option 1 – Uses a Bonded or Customs Warehouse

We will require:

- Customs Contact Information

- First Name, Last Name

- Job Title

- Email Address

- Phone Number

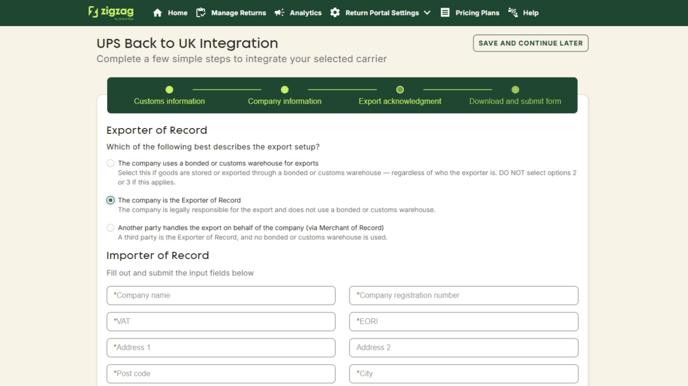

If you select Option 2 – Company is the Exporter of Record

We will require:

- Importer of Record Information

- Company Name

- Company Registration Number

- VAT Number

- EORI Number

- Address (Address 1, Address 2, City, Postal Code, Country)

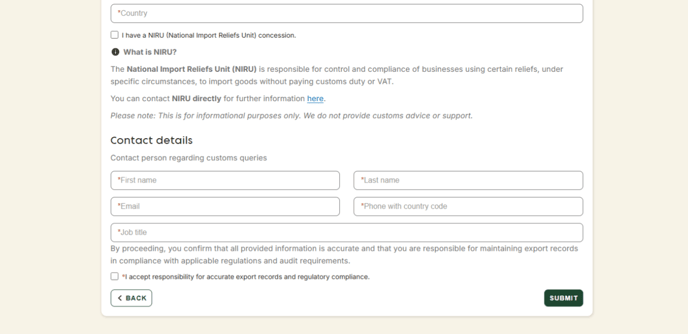

- Customs Contact Information

- First Name, Last Name

- Job Title

- Email Address

- Phone Number

If you have a NIRU (National Import Relief Unit)/ RGR (Return Goods Relief) concession, you will be provided with the appropriate form to complete in a later step.

NIRU is responsible for controlling and ensuring compliance for businesses using certain reliefs to import goods without paying customs duty or VAT. You can contact NIRU directly for further information here.

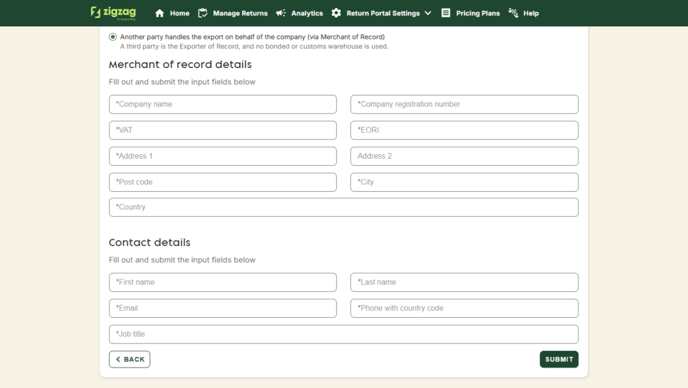

If you select Option 3 – Another Party Handles the Export

We will require:

- Merchant of Record Details

- Company Name

- Company Registration Number

- VAT Number

- EORI Number

- Address (Address 1, Address 2, City, Postal Code, Country)

- Customs Contact Information

- First Name, Last Name

- Job Title

- Email Address

- Phone Number

Step 4 - Download and Submit form

Step 4.1 - Upload forms

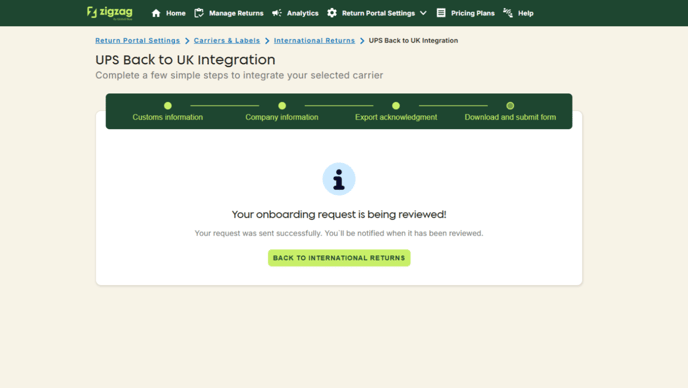

This step will only appear if you selected Option 2 in Step 3. In that case, you will be prompted to download, print, and wet-sign the required form. Once completed, you will need to upload the signed form to finalise your onboarding (pdf or image). After the form is received, our team will notify you as soon as your carrier is live.

If you did not select Option 2, our team will contact you directly, handle your case, and guide you through the next steps to get onboarded to the carrier.

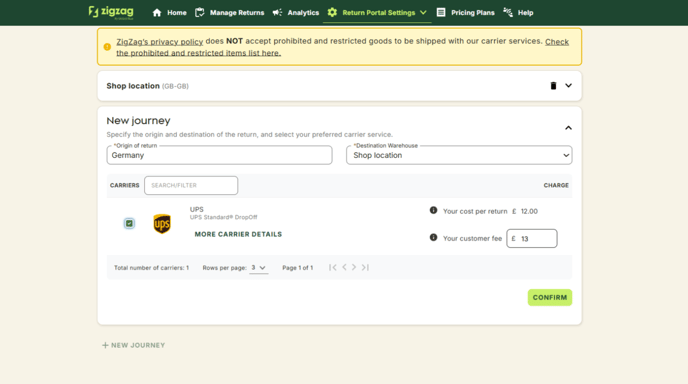

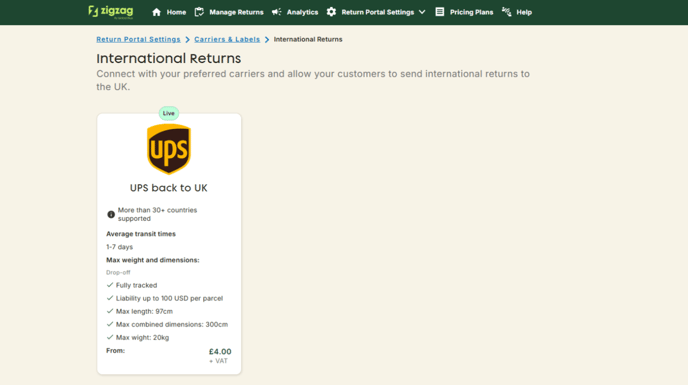

Set up a new return journey using UPS

Once your application is approved you will be able to set up a new return journey for UPS.

The carrier will have tag "Live", as shown on the screenshot below

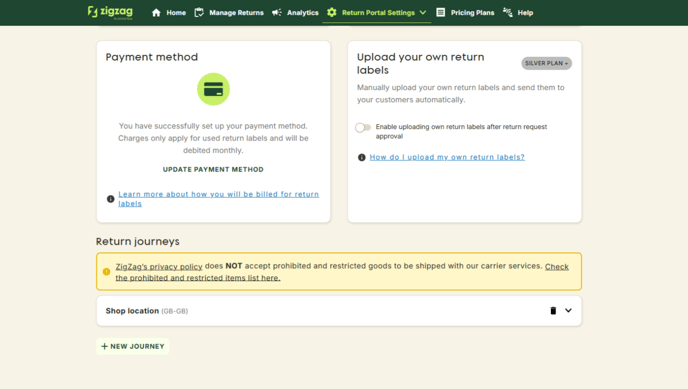

Click on the "New Journey" option

Fill in the Origin of return and Destination Warehouse fields and from the listed carriers choose UPS